Amity School Of Business 1 Amity School Of Business BBA Semister four Financial Management-II Ashish Samarpit Noel. - ppt download

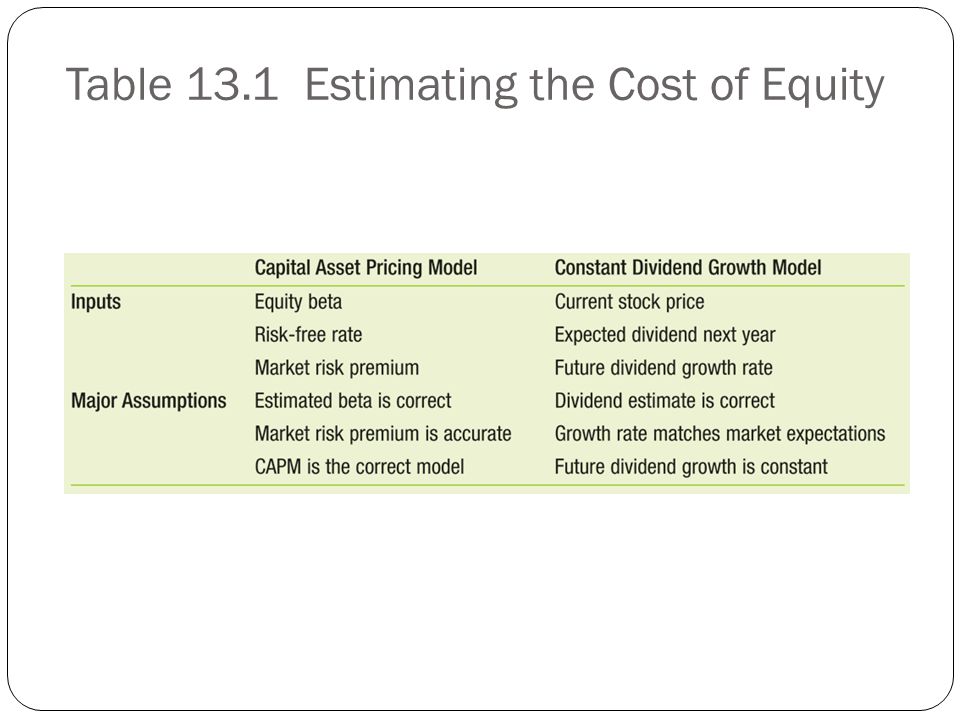

THE COST OF CAPITAL CHAPTER 9. LEARNING OBJECTIVES Explain the general concept of the opportunity cost of capital Distinguish between the project. - ppt download

capm - Dividend Discount Model for a stock and its derivatives - Quantitative Finance Stack Exchange

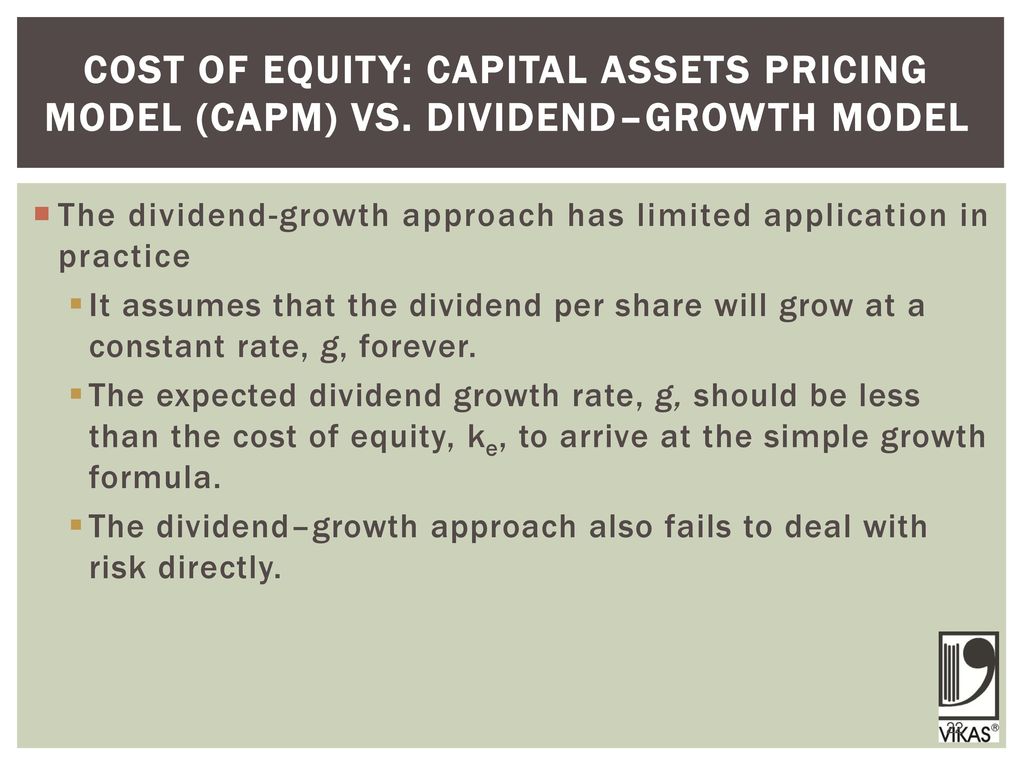

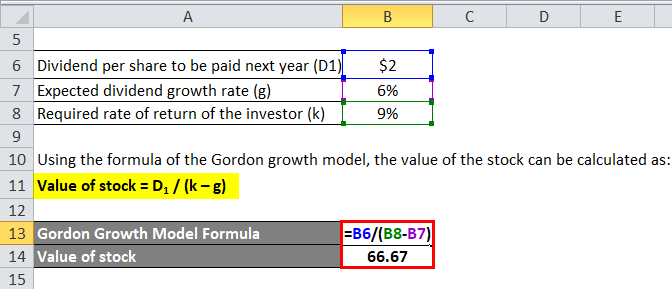

SOLVED: C.Problem: (06marks) Company C's stock has beta 1.2,the risk-free rate is 6%,and the market expected return is 11%,what will be Company C's cost of equity using the Capital Asset Pricing Model(CAPM?

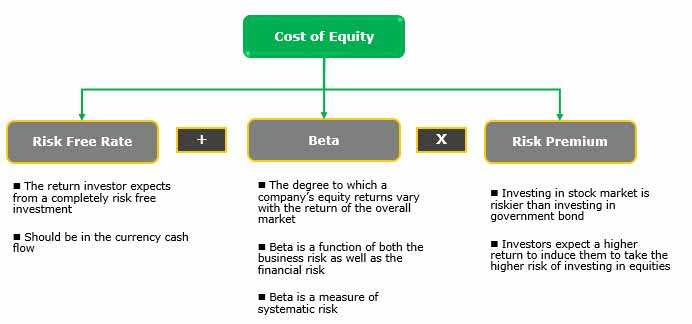

CAPM: theory, advantages, and disadvantages | F9 Financial Management | ACCA Qualification | Students | ACCA Global

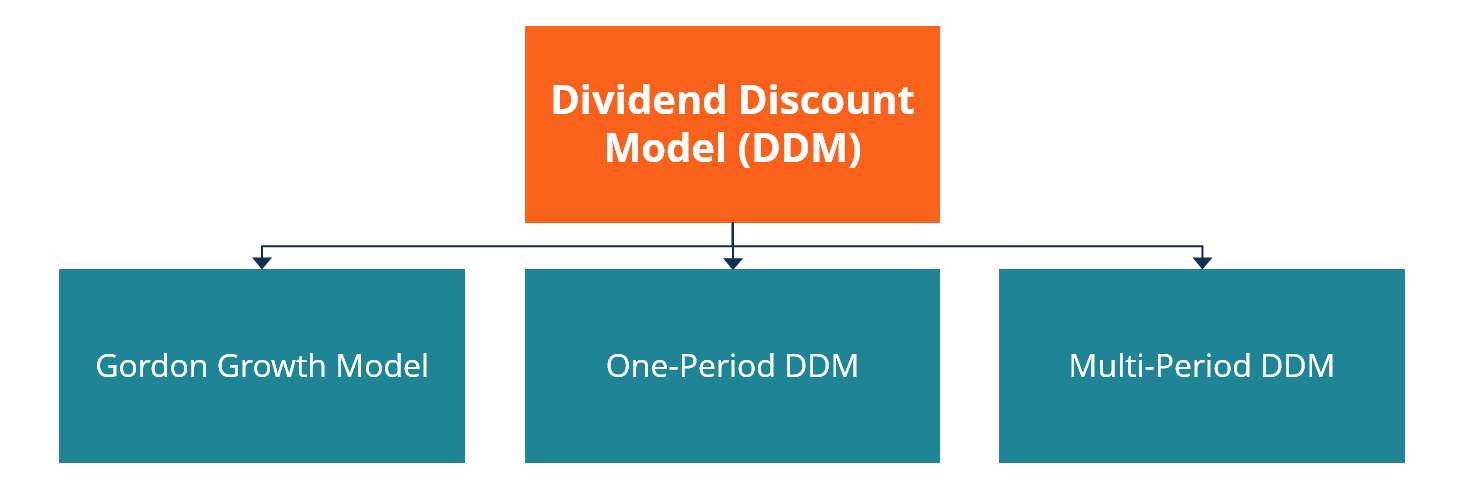

:max_bytes(150000):strip_icc()/ddm-6340db943f88443eafd0dde9a1a80688.jpg)

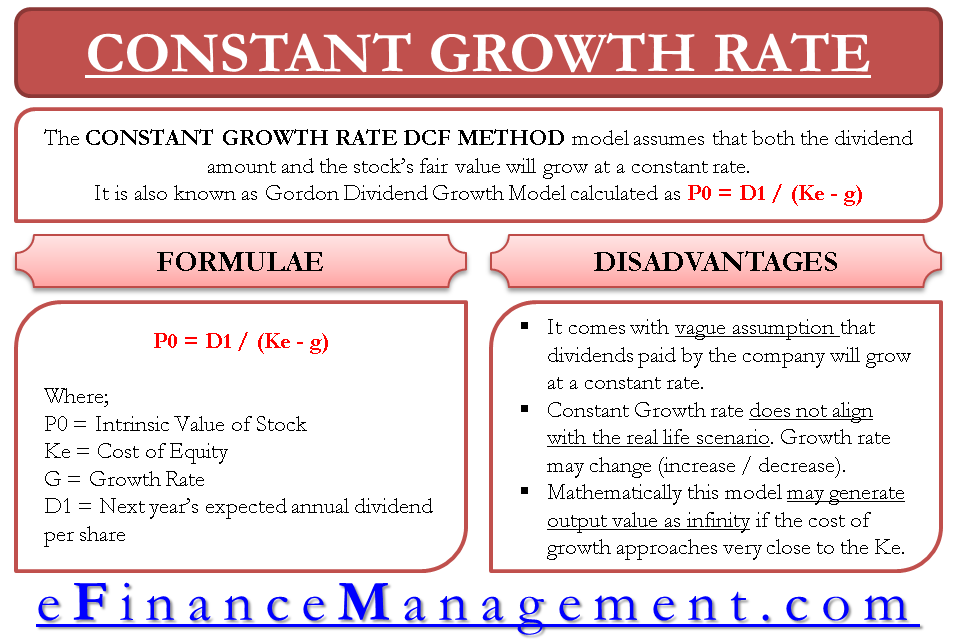

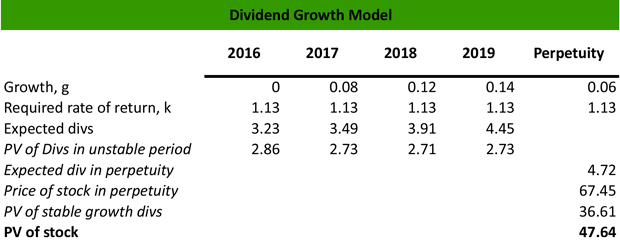

![Dividend Growth Model - [ Definition, Formula, Business Example ] - Dividend Growth Model - [ Definition, Formula, Business Example ] -](https://www.stockmaster.com/wp-content/uploads/2020/01/dividend-growth-model.jpg)

:max_bytes(150000):strip_icc()/GettyImages-1126388682-faaf2b46afd54db78f92b8ed7896de56.jpg)

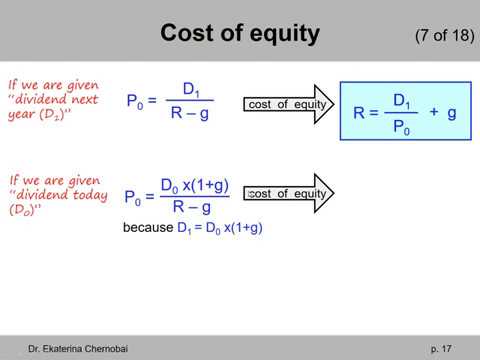

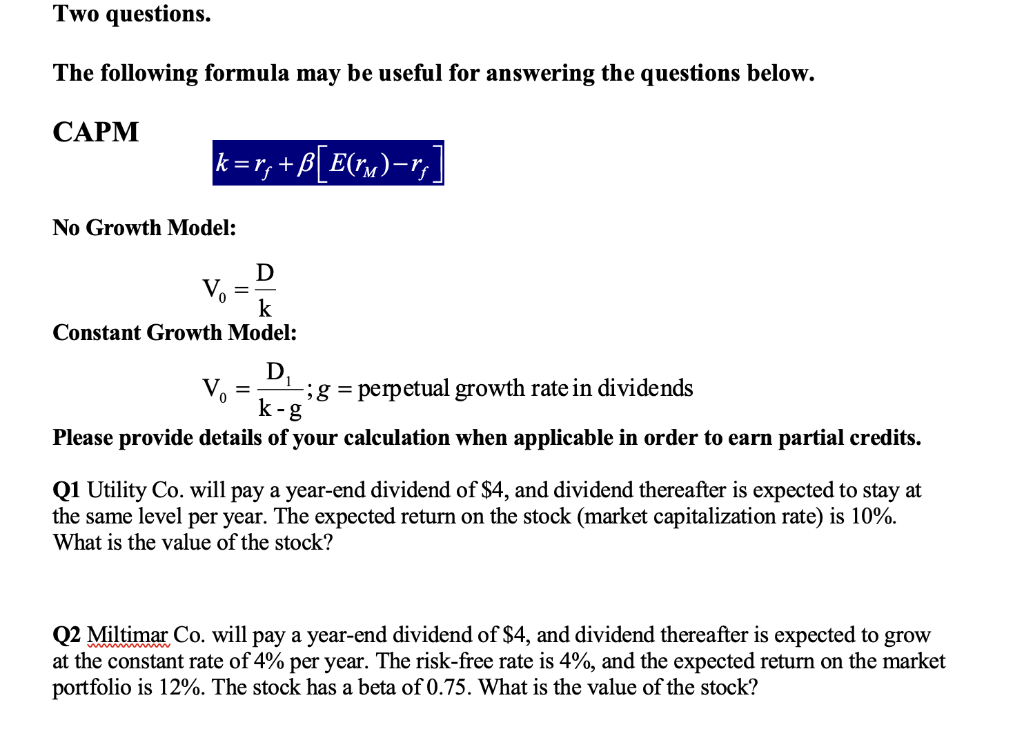

![Solved CAPM k=r;+B[E(ru) –r,] No Growth Model: V: = = D k | Chegg.com Solved CAPM k=r;+B[E(ru) –r,] No Growth Model: V: = = D k | Chegg.com](https://media.cheggcdn.com/media/37f/37fd3076-8bc0-40cc-a686-07a2e9c8d2a8/phptkukYr)