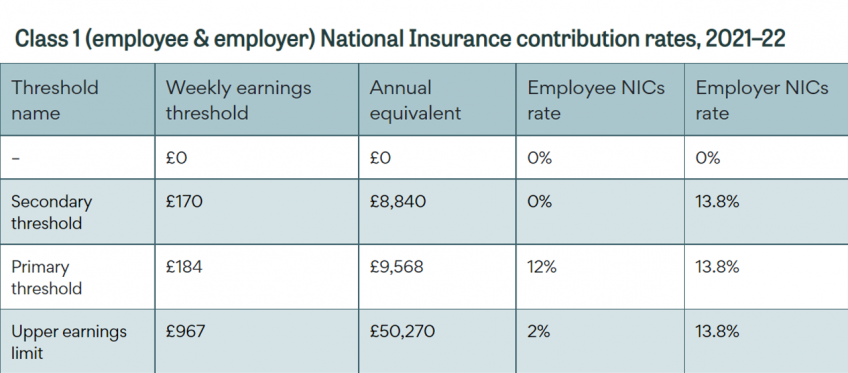

Charging national insurance at 12% on all employees, including those earning over £50,000 a year, could raise £14 billion of extra tax a year

United Kingdom: National Insurance Contribution (NIC) easement due to COVID-19 for employees not covered by a social security ag

Penalising the poor: HMRC charged 400,000 with penalties when they had no tax to pay – Tax Policy Associates Ltd

Overseas employees potentially face double NICs liability following a no-deal Brexit | Accountants Bury St Edmunds & Thetford - Knights Lowe